For instance, stationery, office equipment and machine components for a factory are expenses a company has regardless of whether it's producing a specific item. SuppliesĪlthough many supplies are non-G&A costs, such as concrete for a construction project, any costs that do not directly aid a project qualify as general and administrative expenses. G&A for organizations like these are important because they establish a company's credibility and expose them to new customers. For instance, the hospitality industry has the American Hotel and Lodging Association and many more. Specific industries also have membership-based organizations.

#General and administrative expenses professional#

The cost to apply for and renew these licenses count as general and administrative expenses.įees are a broad category and include professional memberships like a local Chamber of Commerce. Cosmetologists must have state licenses to perform their services. Restaurants, for example, must have food and beverage licenses to serve customers. Related: How Does Workers' Comp Work? A Complete Guide Licenses and feesīusinesses of all kinds require licensure to operate. Other types of insurance include business income insurance, which protects a company if production stops, or workers’ compensation insurance, which ensures employees receive payment if they're injured on the job. For instance, medical facilities and law offices are often required to carry malpractice insurance to cover their staff. In addition to insurance that protects business property, many organizations require insurance on personnel or the company itself.

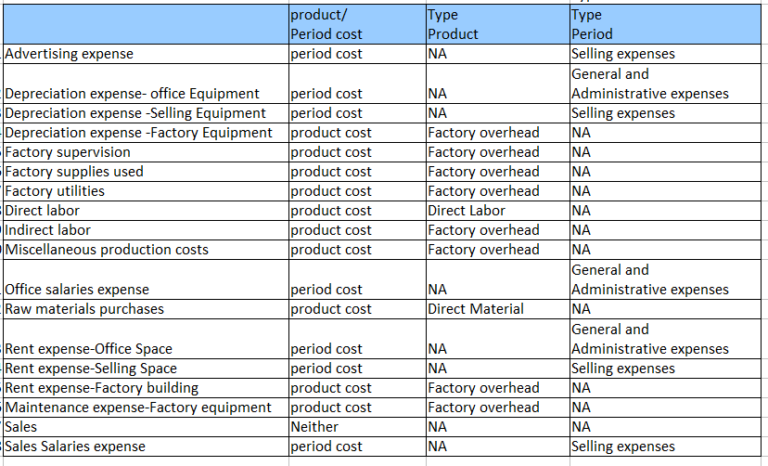

Related: What Is Labor Cost? Definition, Direct vs. Some other employee-related G&A costs include relocating a new hire and paid travel for job-related training. In addition to an employee's actual pay rate, costs like paid time off, health insurance and training also qualify as G&A.

#General and administrative expenses how to#

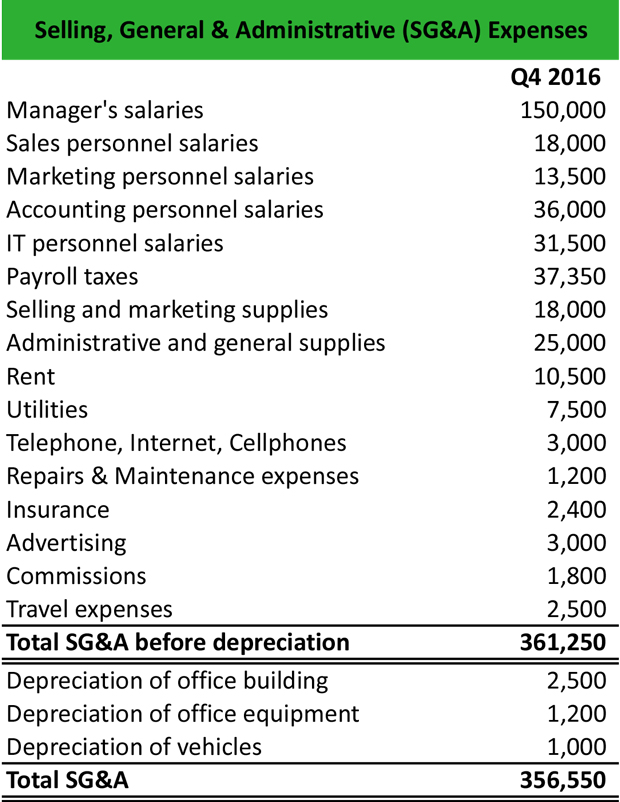

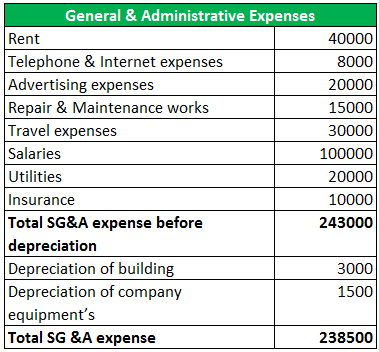

Related: How To Use Construction in Progress Accounts Salaries and wagesĮmployee salaries and wages are other major components of general and administrative expenses. Even minor operating expenses like lawn service and cleaning fall in this category. Utilities are also common costs, which include electricity and water. Rent or mortgage on the building is one example, as is any property insurance the organization holds, such as fire and flood. The types of G&A expenses a company has can vary widely depending on its size and industry, but most fall into these categories: Building expensesīuilding expenses pertain to any costs related to operating the facility that houses the company. Read more: What Are Operating Expenses? (With Examples) Types of G&A costs

For instance, if you own a stained-glass workshop, G&A expenses would be the rent on your studio and overhead would be the cost of your glass, polish, metal framing and other materials. G&A expenses can include rent, insurance, utilities and any other day-to-day operations of a business. Overhead specifically pertains to the costs of producing a good or service or otherwise completing a task. G&A is similar to overhead, but the terms differ in that G&A costs accrue regardless of whether a company is working on a project. Also called indirect costs, G&A expenses are fixed, which means they do not vary based on sales or other production levels. Because these are general expenses, they typically apply to the whole company rather than one facility or department.

General and administrative expenses, often referred to as G&A, is an accounting term for a portion of a company’s operating expenses. What are general and administrative expenses? In this article, we define general and administrative (G&A) expenses, provide examples of administrative expenses and explain how to calculate G&A. Business expenses often include those related to selling products, such as marketing costs, but another category pertains to costs that typically remain fixed over time. When involved in tracking or managing a company's expenses, it’s crucial to understand the main categories costs can fall into.

0 kommentar(er)

0 kommentar(er)